Employee Benefit Services

Enhance your benefits package at no cost to your business

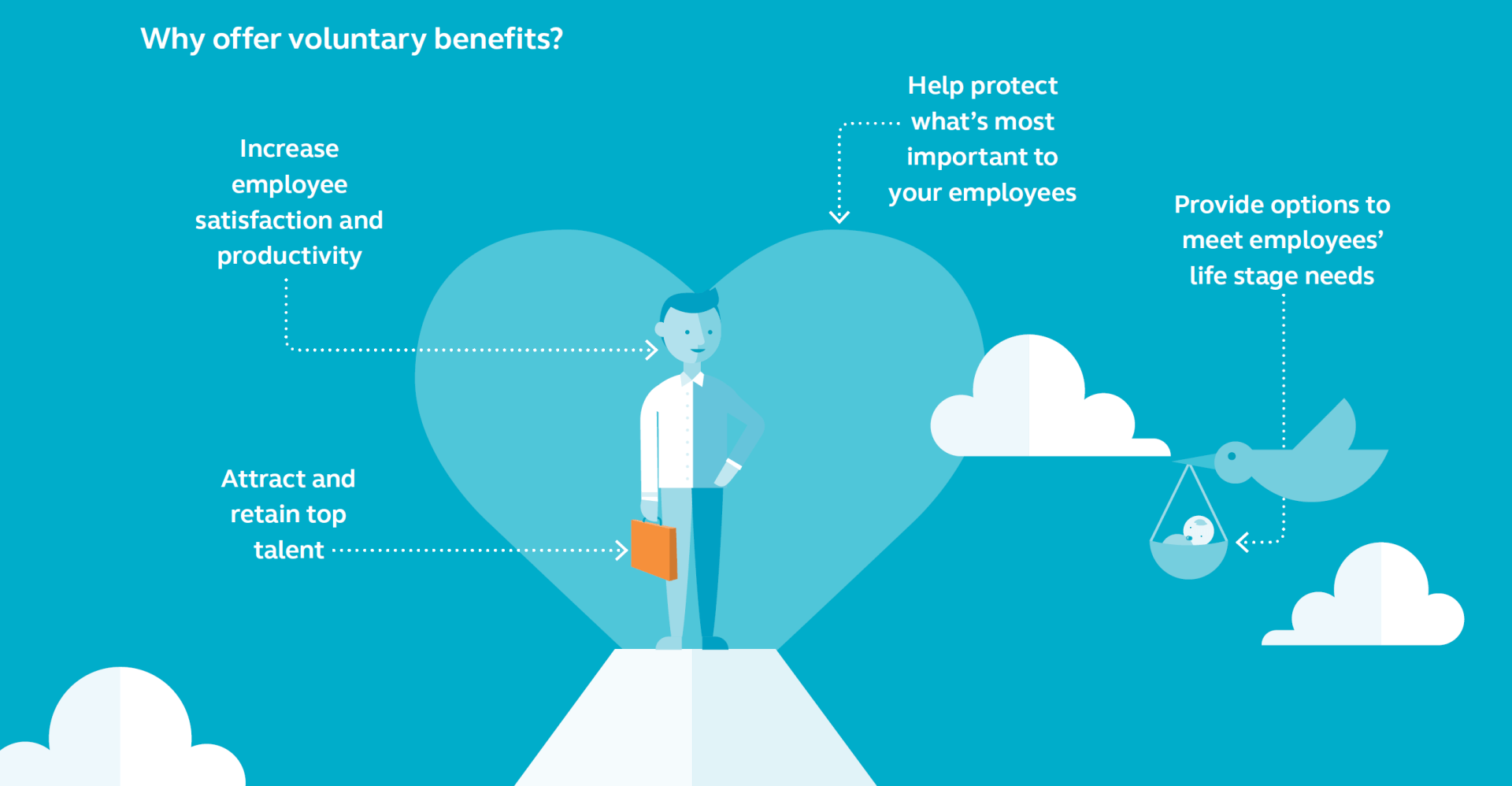

Voluntary benefits help you offer outstanding employee benefits

No matter the size of your business or your budget, you can offer employees the benefits they want and need. Many businesses use employee-paid benefits to round out their benefits packages. BAW can help you provide quality voluntary dental, short-term and long-term disability, life, vision, critical illness* and accident solutions.

Great employee benefits can help you attract and keep quality employees.

But providing benefits for employees can be a challenge. No matter how big—or small—your company or budget, you’ll find BAW benefit solutions can meet your needs. Our comprehensive products and services give you the flexibility to design benefits that work for you and your employees.

Why choose BAW for your benefits?

- Customize coverage to help meet your employees’ needs.

- Choose to pay all, part, or none of the premium.

- Tailor benefits to your specific business size.

| # Employees | You Can Offer: |

|---|---|

| 2+ | Employer-paid coverage |

| 5+ | Voluntary employee-paid coverage |

| 100+ | Self-funded coverage |

An employee benefits leader you can count on

Take advantage of our experience and commitment to service. You can depend on BAW—we’ve been delivering flexible and affordable employee benefit solutions for over 30 years.

Make the most of your benefit dollars. With BAW, you get the quality coverage and services to do just that!

Dental. Your business is one of a kind. That’s why we make it easy to offer dental benefits tailored just for you and your employees. And our large network of dentists means employees have more choice in who they see.

Disability. Whether you need short-term disability, long-term disability, or both, we’ve got you covered. Plus, our definition of disability can make a difference at claim time. Our specialized solutions are designed to serve all employees, including business owners.

Life. You, your employees, and their beneficiaries all have different needs for life insurance. That’s why our flexible products are such a nice fit. Plus, employees’ loved ones will find the claims process fast and easy.

Vision. It’s simple to administer and is a great way to round out your benefits package. And employees appreciate being covered for services like exams, glasses, and contacts.

Supplemental benefits. Enhance your benefits with critical illness5 and accident insurance. They pay lump-sum cash benefits directly to employees, regardless of other insurance coverages or actual expenses. The purchase process is straightforward for you and your employees with our simplified product designs.

Our online benefits administration programs, available 24/7, take the hassle out of administering benefits for both you and your employees. From ongoing member and salary updates to enrollment and payroll deduction reports, these programs make managing benefits a snap.

Solutions you can tailor to your needs

Our customizable solutions let you select from a variety of features and benefits. Here’s a brief summary of what we offer. Talk to your Principal representative to get the full story.

Our service goes beyond our products

Implementing benefits, educating and enrolling employees, administering benefits—sounds like a lot. Is there a smooth way to handle it all? Yes! Take advantage of our services that take the load off you and your human resources staff. That means you can spend more time focused on what really matters—running your business.

Our education and enrollment services help increase employee participation, without creating more work for you. You choose how to:

- Educate employees—in group or one-on-one meetings

- Enroll employees—online, paper, or census

BlueCare: Get Care from Anywhere!

Online medical and behavioral health visits are available to members and any dependents who are covered on their plans. All BlueCare providers are U.S. trained and board-certified.

Medical Visits

- BlueCare costs less than the ER and urgent care centers.

- BlueCare lets you see doctors online, 24/7, to treat non-emergency, common conditions like fever, colds and cough, stomach bugs or pink eye.

Behavioral Health Visits

- Online appointments for behavioral health needs are available with BlueCare. Simply log in and schedule a visit with a psychology or psychiatry provider.

- BlueCare behavioral health appointments can be a good service for members who may be feeling depression, grief, stress, life transitions, anxiety, couples’ counseling and more.

Drugs may be prescribed if needed. Prescription availability is defined by physician judgment; certain types of medication may not be prescribed. Before your BlueCare visit, you’ll see what it will cost. This depends on your plan type and benefits.

You can use any major credit card, and even HSA or FSA cards, to pay for BlueCare. Your card will not be charged until your visit is over.

Blue365®: Healthy Discounts and Deals

Blue365® offers you discounts on health and wellness resources, 365 days a year. Blue Cross and HMO members enjoy special discounts on many services, such as:

- Gym memberships

- Nutrition deals

- Sports clothing and shoes

- Eye care

- Elective procedures (ex. LASIK)

- Hearing aids

Choose the Plan That's Right for You

We are committed to offering value with our health insurance plans. Your covered employees can take advantage of innovative health programs focused on keeping them well. Plus, they will have access to value-added wellness programs and exclusive discounts on wellness services such as gym memberships, spas and more.

- Group Care PPO

- BlueSaver

- Premier Blue

- HMO Plans

- Blue Point of Service